AML Sanction List

AML sanctions refer to lists of individuals, organizations, and countries that national and international authorities have identified as engaging in criminal activities or supporting terrorism. These comprehensive lists play a crucial role in preventing illicit financial transactions. Financial institutions and businesses utilize these AML sanctions lists to identify and avoid conducting transactions with individuals and entities that are subject to sanctions.

Government agencies, including the Office of Foreign Assets Control (OFAC) in the United States, the United Nations Security Council, the European Union, and various other national and international bodies, are responsible for compiling and maintaining these AML sanctions lists.

Our AML Data

AML Sanctions Lists are compiled and maintained by government agencies such as the Office of Foreign Assets Control (OFAC) in the United States, the United Nations Security Council, The European Union, and other national and international agencies.

Total Data 1M+

Get access to a meticulously arranged database covering details about PEP and entities listed in AML Sanction Lists, spanning across the global landscape.

Countries 80+

World’s largest data of Sanctions, PEPs, and AML related information in a single platform. Data contains details about more than 80+ Countries.

Regular Updates

With the Update Monthly feature, we can provide our customers with the most up-to-date AML, PEP and Sanction Lists information available.

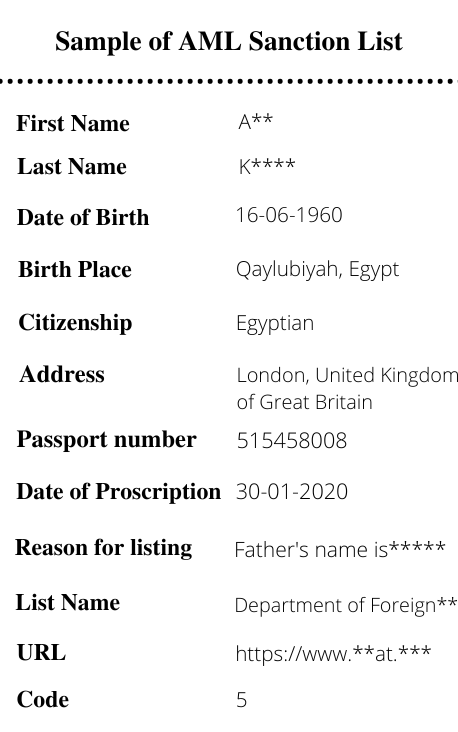

Sample of AML Sanction List

What is the AML Sanctions List? How is it important for AML Compliance?

These lists are published by government and international authorities to combat illegal trade activities engaging sanctioned individuals, organizations, and countries. Firms are required to screen individuals, organizations, or governments against these lists as they may pose a high risk. Economic sanctions play a vital role in the efforts of AML regulators preventing financial crimes and breaching sanctions can attract hefty penalties.

AML sanctions lists are important for AML Compliance because they provide financial institutions with a tool to identify and prevent transactions with sanctioned entities, which ultimately helps to mitigate the risk of money laundering, terrorism funding, and other illicit activities. Financial institutions are legally required to screen their customers, transactions, and counterparts against AML sanctions list to ensure that they are not inadvertently conducting business with sanctioned entities.

It is important to note that sanctions can change frequently, with new individuals or entities added or removed based on changing circumstances. Therefore, it’s important for businesses to regularly update their compliance systems and stay informed of any changes to the AML sanctions lists in order to inadvertently avoid engaging in transactions that are punishable by law.

Avoiding transactions with sanctioned entities helps prevent unwitting involvement in illegal activities and contributes to global efforts to combat financial crime and terrorism.

Disclaimer for the Sample Datasets- Please note that the above-shared dataset is displayed for representative purpose. The purchased dataset will contain variable fields subject to availability.

WE GUARANTEE 98% ACCURACY WITH TOP-QUALITY DATA.

What does an AML sanctions list consist of?

An AML sanctions list is a list of individuals, entities, organizations, and countries that are subject to financial sanctions. These sanctions are usually imposed by governments, regulatory bodies, or international organizations, and they are intended to prevent money laundering, terrorism financing, and other financial crimes. Sanctions lists may include names of known terrorists, criminals, or entities associated with prohibited activities or countries that are under political or economic sanctions. Financial institutions are required to screen their customers and transactions against these lists to prevent any business dealings with listed individuals or entities. The lists are frequently updated to reflect the latest developments and to keep pace with changing geopolitical situations.

It is important to note that sanctions lists are constantly changing, and new names are added or removed as situations change. Therefore, financial institutions must ensure that their sanctions screening systems are regularly updated with the latest information to ensure compliance with AML regulations. Failure to comply with AML sanctions screening requirements can result in significant fines and penalties, as well as reputational damage and loss of license to operate.

With our AML Sanctions List, you will receive the following data fields(*Subject to availability):

Why is it important for businesses to have access to an AML sanctions list?

Businesses and financial institutions use the AML sanctions list to verify transaction details against sanctioned individuals or entities, reducing the risk of financial crimes such as money laundering and terrorist financing. Access to an updated AML sanctions list helps businesses comply with regulatory requirements, manage risks effectively, and make informed decisions. Some of the major industries that rely on the list are:

For Banks & Other Financial Institutions:

AML sanctions list helps banks and other financial institutions by providing them with a tool to identify individuals who may pose a higher risk for financial crimes.... By screening their customers against the AML sanctions list, banks can take extra precautions to ensure that they are not inadvertently facilitating illicit activities such as corruption, bribery, or terrorist financing. Read More

For the Betting Industry:

The AML list can be a valuable tool for the betting industry to help prevent financial crimes, comply with regulatory requirements, and protect the integrity of the sports... they offer. By using AML lists, the betting industry can conduct enhanced due diligence on customers who are AMLs or are associated with AMLs. This can involve additional background checks and monitoring of transactions to ensure that they are not being used for illicit purposes. Read More

For Payment & Insurance Companies:

In addition, the AML list can also help payment companies comply with regulatory requirements, such as Politically Exposed Person List (PEP) and counter-terrorist... financing (CTF) regulations. Whereas for insurance companies, by screening their customers against the PEP list, they can ensure that they are not providing coverage to high-risk individuals or entities that may be involved in such activities. Read More

For the Legal Industry:

The AML list can also help law firms comply with regulatory requirements, such as PEP and CTF regulations. They use the AML list to screen their clients to identify any... high-risk individuals or entities that may be involved in financial crimes or other illegal activities. By doing so, they can avoid potential reputational damage or legal liabilities that could result from being associated with such individuals or entities. Read More

For Investment & Crypto Companies:

Investment companies, such as asset management firms and private equity firms, may use the AML list to screen potential investors and clients to identify... any high-risk individuals or entities that may pose a threat to the integrity of their business. Similarly, for crypto companies by screening out potential AML risk individuals they can ensure that their platform is not being used for illegal activities and avoid regulatory penalties. Read More

For Real Estate Industry:

In the real estate industry, knowing whether a potential client is on the AML list can help real estate professionals identify any potential risks associated with the transaction... . For example, if a real estate agent is working with a AML who has been flagged as a high-risk individual, the agent may want to take additional steps to verify the source of the AML’s funds and ensure that the transaction is legitimate. Read More

WHAT WE OFFER HERE?

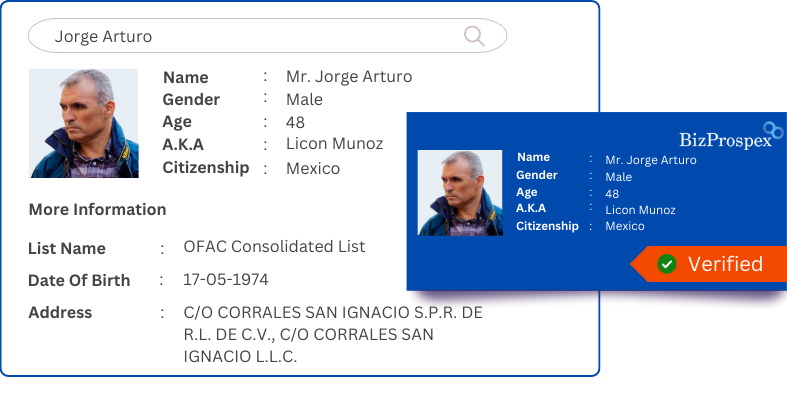

At BizProspex we provide you with extensive details of individuals who have undergone PEP screening and are listed on the international sanctions list. For a better understanding, we share a free sample to get an insight of our project scope!

BizProspex- The experts on B2B Data Services!

Disclaimer for the Sample Datasets- Please note that the above-shared dataset is displayed for representative purpose. The purchased dataset will contain variable fields subject to availability.

Why should you purchase our AML sanctions list database?

Our list is regularly updated to ensure businesses have access to the most current information, helping them make informed decisions and stay ahead of potential risks. By using our AML Sanctions List, you can improve efficiency by reducing the time and resources required to manually compile and maintain their own list. At BizProspex, avoid negative publicity and get assistance with compliance with sanctions regulations.

Compliance with regulatory requirements

Many countries have laws and regulations that require financial institutions and other businesses to screen their customers... and transactions against sanctioned individuals and entities. By using our comprehensive AML Sanctions List, businesses can ensure that they are meeting their legal obligations. Read More

Access to up-to-date information

Sanctions lists are constantly changing as new sanctions are imposed and existing sanctions are lifted. We assist... you in this regard by providing regular updates to ensure that you have access to the most current information. Read More

Enhanced risk management

Screening against an AML Sanctions List is an effective way to mitigate the risk of money laundering, terrorist financing, and... other illegal activities. Using our AML sanctions database can help businesses identify high-risk individuals and entities and take appropriate action to manage these risks. Read More

Reputation management

Failure to comply with sanctions regulations can result in severe financial and reputational consequences. Using our... expert & trusted AML Sanctions List can help businesses avoid negative publicity and damage to their reputation. Read More

Improved efficiency

Manually compiling and maintaining a list of sanctioned individuals and entities can be time-consuming and error-prone... . Using our AML Sanctions List can help businesses save time and reduce the risk of errors. Read More

Flexible options

We provide an easy to use database that can integrate with existing systems and processes. We also provide... customizable options to fit the specific needs of the business, such as the ability to set different levels of risk thresholds, customize search criteria, and generate reports. Read More

Similar Database

AML Sanction List

Real-time AML Sanctions List- Stay compliant and informed with up-to-the-minute data from reliable sources.

PEP List

Ensure compliance with our PEP Sanctions List – real-time updates on PEPs and sanctioned individuals.

Global Sanctions Database

Stay secure with our Global Sanctions data feed. Ensure compliance and protect your business reputation.

Our Services

Effective PEP and AML Sanctions Screening Compliance

Achieve effortless adherence to PEP and AML Sanctions screening requirements with BizProspex’s comprehensive Anti Money Laundering and Counter Terrorism Financing solution. Safeguard your AML/CTF compliance during customer onboarding through:

With BizProspex, you can seamlessly ensure compliance with PEP and AML sanctions screening without any hassle.

Country Wise Sanctions List

| TOP COUNTRY | TOP COUNTRY |

|---|---|

| UK Sanctions List | Iran Sanctions List |

| UN Sanctions List | EU Sanctions List |

| Russia Sanctions List | US Sanctions List |

| Japan Sanctions List | OFAC Sanctions List |

| Venezuela Sanctions List | HMRC Sanctions List |

| SDN Sanctions List | UNSC Sanctions List |

| Syria Sanctions List | Israel Sanctions List |

| Ukraine Sanctions List | And More |

Experience that defines BizProspex

BizProspex is a data solutions company that has been in the industry for 13 years and is still going strong. Over these years, BizProspex has worked with a wide range of clients from various industries including healthcare, finance, retail, and technology. The company has helped these clients to achieve their data-related goals and improve their business outcomes.

We specialize in providing AML & PEP sanction list services to our B2B clients, helping them to effectively manage risk and ensure compliance with regulations. Our experience in handling these services has allowed us to become global leaders in the data industry. With BizProspex, our clients can feel confident that they’re receiving the best possible service to achieve their compliance goals.

What do our experts have to say?

Our experts at BizProspex are skilled at curating AML & Global Sanctions Database for our B2B clients. Our data solutions company has a team of data experts who provide accurate and reliable data solutions to their clients using their knowledge and experience. We offer services such as data mining, data cleansing, data appending, data verification, and data enrichment.

Our goal is to provide high-quality data solutions that are accurate and reliable for their clients. With our AML & PEP sanction list services, we help our B2B clients to effectively manage risk and ensure compliance with regulations.

Frequently Asked Questions

What is an AML sanctions list?

An AML sanctions list is a list of individuals, entities, and countries that are subject to economic sanctions and restrictions imposed by governments or international organizations to combat money laundering, terrorist financing, and other financial crimes.

How often is the AML sanctions list updated?

An AML sanctions list is updated regularly, as new sanctions are imposed, and existing sanctions are lifted. The frequency of updates varies depending on the source of the list.

What are the consequences of non-compliance with sanctions regulations?

Non-compliance with sanctions regulations can result in severe financial and reputational consequences, as well as legal penalties. Businesses may face fines, sanctions, loss of licenses, and negative publicity, which can harm their reputation and bottom line.

How can businesses use an AML sanctions list to enhance their due diligence efforts?

By screening their customers and transactions against an AML sanctions list, businesses can identify potential risks and take appropriate measures to prevent financial crimes. The AML sanctions list can provide additional information to support due diligence efforts, such as identifying high-risk individuals and entities.

How long does it take to get my AML sanctions list after I order it?

Upon receiving an order, we promptly retrieve new data for you, which typically takes less than 48 hours to process and make available for your use.

When were your data lists last updated?

To guarantee the precision and dependability of our data, we conduct regular checks and updates, ensuring our clients receive the most up-to-date information possible in the market.

Is your data downloadable in Excel files?

Certainly, our data can be downloaded in various formats, including Excel files, .csv files, and .txt files.

Is your accuracy guaranteed?

Our Bounce-Back Guarantee ensures that all the records we offer have a minimum accuracy rate of 98%. In the rare event that you experience a lower accuracy rate, you can reach out to our customer relations team, and we will provide you with new data at no additional cost to compensate for the discrepancy.

What Our Clients Say

BBB Rating: A+

TrustScore 3.8

Rating 4.9

Rating 4.8

Rating 5

Rating 4.9

B2B Data

- GoodFirms Top Big Data Analytics Companies List 2024

- Wellfound Top Tech Startup Companies List Southern Europe 2024

- Wellfound Top Tech Startup Companies List Western Europe 2024

- Inc. 223 Southeast Regionals Companies List 2024

- Inc. 162 Southwest Regionals Companies List 2024

- Inc. 72 Rocky Mountain Regionals Companies List 2024

- Inc. 170 Pacific Regionals Companies List 2024

- Forbes Middle East Top 100 Listed Companies 2024

- Inc. 198 Northeast Regionals Companies List 2024

- Inc. 172 Midwest Regionals Companies List 2024

- Inc. 135 Mid-Atlantic Regionals Companies List 2024

- Capital Market Top 500 Companies List in India

- Failory Top 216 Italy Startup Companies List 2024

- Wellfound Top Tech Startup Companies List, Europe 2024

- Wellfound Top Tech Startup Companies List, Poland 2024

- Corporate Knights Global 100 Companies List 2024

- TIME100 Most Influential Companies List 2024

- Fortune 100 Best Companies to Work For 2024

- Inc. Regionals Companies List 2024

- Wellfound Top Tech Startup Companies List Switzerland 2024

- Zemo Partnership Members List

- Data Centre Directory

- Forbes Global 2000 Companies List 2024

- Failory Top 267 Poland Startup Companies List 2024

- Wellfound Top Tech Startup Companies List Netherlands 2024

- Failory Top 300 Switzerland Startup Companies List 2024

- Failory Top 300 UK Startup Companies List 2024

- Statista R France’s Fastest Growing Companies List 2024

- Failory Top 300 France Startup Companies List 2024

- Built In Top Tech Companies in Kansas City, MO 2024

- Failory Top 300 German Startup Companies List 2024

- Built In Top Tech Companies in Nashville, TN 2024

- Built In Top Tech Companies in Detroit, MI 2024

- Built In Top Tech Companies in Charlotte, NC 2024

- Built In Top Tech Companies in Atlanta, GA 2024

- Built In Top Tech Companies in Indianapolis, IN 2024

- Wellfound Top Tech Startup Companies List, Georgia US 2024

- Failory Top 178 Massachusetts Startups Companies List 2024

- GoodFirms Top IT Services Texas Companies List 2024

- Wellfound Top Tech Startups Companies List, Florida US 2024

- Failory Top 300 California Startup Companies List 2024

- GoodFirms Top Software Texas Companies List 2024

- Built In 50 Best Startups to Work for in Austin, TX 2024

- Built In 50 Best Startups to Work for in the US 2024

- F6S Top 100 Texas Companies and Startups List 2024

- F6S Top 100 Dallas Companies and Startups List 2024

- Failory Top 79 Texas Startup Companies List 2024

- Fast Company The World’s Most Innovative Companies List 2024

- Clutch Top 100 Fastest-Growing Companies List 2024

- FT 1000: Europe’s Fastest Growing Companies List 2024

- F6S Top 100 Sweden Companies and Startups List 2024

- Wellfound Top Tech Startups Companies List, Massachusetts US 2024

- Wellfound Top Tech Startups Companies List, Texas US 2024

- Forbes America’s Best Startup Employers List 2024

- FT 1000: Europe’s Fastest Growing Companies List 2023

- International Business Companies List

- F6S Top 100 Netherlands Companies and Startups List 2024

- Wellfound Top Tech Startup Companies List, Alabama US 2024

- Wellfound Top Tech Startup Companies List, Michigan US 2024

- F6S Top 100 UK Companies and Startups List 2024

- F6S Top 100 German Companies and Startups List 2024

- F6S Top 100 US Companies and Startups List 2024

- Forbes Global 2000 Companies List 2023

- Deloitte Fast 500 Companies List 2024

- Failory Top 300 US Startup Companies List 2024

- FT The Americas Fastest Growing Companies List 2023

- Inc. 5000 US Companies List 2024

- Inc. 5000 Europe Companies List 2024

- List of Fortune 500 Companies 2024

- SaaS 1000 Companies List

- Deloitte Fast 500 Companies List 2023

- Mailing List By Zip Code

- Small Businesses Email List

- List of New Businesses

- Companies Email List

- List of Local Businesses

- List of Fortune 500 Companies 2023

- Email Marketing List

- Business Email List

- Church Email List

- AML (Anti-Money Laundering) Sanction List

- Global Sanctions Database

- Politically Exposed Person List

- Global Investors Email List (Find the Top VC/Angel Investors across the World)

- Top Funded Companies List Worldwide (Details of c-level executives across various industries)

- Zoho Address Appending Solution

- Free List of Recently Funded Startup Companies

- Taboola Customers Email List

- Adobe CQ Customers Email Lists

- Email Database of All Decision-Makers

- E-commerce Websites Using Amazon Worldwide

- Amazon AWS Data Partner

- Targeted Email List

- CFO Email Lists

- CEO Email Lists

- USA Business Email List

- Inc. 5000 Europe Companies List of 2023

- Inc. 5000 Europe Companies List of 2021

- OpenX Customer list

- Pubmatic Customer List

- Media Innovation Group Users Database

- IponWeb BidSwitch Customer List

- IndexExchange Reseller Users Database

- Website Data DoubleVerify Users

- Live Criteo Customer Worldwide

- ContextWeb Users Database

- BlueKai Customers list

- Live Beeswax Website Database

- AppNexus US Customers Database

- Get AOL Reseller Users List Worldwide

- Amazon Ad System Customer List

- List of Electronic Stores Worldwide

- Get Exclusive Zoho CRM Users List

- Salesforce Users List Globally

- Live Customer Websites Using Drift

- Capterra Website Users Database

- Get MailChimp Users List

- Shopify Customer List Database

- Get PubMatic user’s DB Worldwide

- Get Criteo User’s DB Worldwide

- Get ContextWeb User’s DB Worldwide (100 leads)

- Get Exclusive Infusionsoft users data Globally (200 leads)

- Inc. 5000 US Companies List of 2023

- Get Genuine Memberium Users Database Worldwide (100 leads)

- Websites using MailChimp

- Live Customer Websites using WordPress

B2C Data

- Consumer Email List

- Homeowner Email List

- Mailing List By Zip Code

- Companies Email List

- Convenience Store List

- Email Marketing List

- Opencart Customers Email List

- Drupal Users Email Lists

- BigCommerce Customers Email List

- E-commerce Website Customer Using Blogger, Joomla, Wix

- Live Global E-commerce Stores

- E-commerce Websites Using Amazon Worldwide

- Laravel Customer Email List

- Live Global Home Stores Database

- Websites Using Smart Ad Server Reseller

- Rocket Fuel Consumers Worldwide

- Pubmatic Customer List

- Live Integral Ad Science Website Database

- IndexExchange Reseller Users Database

- FreeWheel Reseller Users Database

- Live Criteo Customer Worldwide

- ContextWeb Users Database

- BlueKai Customers list

- Get AOL Reseller Users List Worldwide

- Amazon Ad System Customer List

- Live Advertising Sites Users List

- Ads.txt Customers List

- Adobe Audience Manager Users List

- Global Womens Fashion Stores Users List

- Worldwide Shoes Stores Email List

- Global Mens Fashion Stores Email List

- Get Kid Stores Located Globally

- List of Jewelry Stores Worldwide

- Database of Household Appliance Stores

- Global Hardware Stores Database

- Worldwide Food Stores Database

- Email List of Flower Stores Globally

- Global Eyewear Stores Email List

- Worldwide Clothing Stores List

- Live Boutique Stores Email List

- Global Book Stores Email List Database

- Beauty Stores Email List Located Globally

- Get Worldwide Baby Stores Database

- Get vCita Users Database Worldwide

- Salesforce Users List Globally

- Live Reevoo Websites Database

- Live Customer Websites Using SAP Hybris

- Infusionsoft Website Users List

- Live Customer Websites Using Drift

- Capterra Website Users Database

- BPM Online Website Users Database

- Get Alexa Top 100 Website Database

- Amazon Website Customers in US

- Zendesk Customers List Database Worldwide

- WooCommerce Plugin Users Database

- Database of ReCharge Payment Website Users

- Ruby on Rails Consumer Database

- PrestaShop Website Users Data

- Volusion Ecommerce Website Consumer List

- Database of Memberleap Users Worldwide

- Get MailChimp Users List

- Live Google Adwords Conversion Websites

- Google AdSense Website Consumer Data

- Get Cratejoy Users Data Worldwide

- Get Fashion Retailers Customer List

- Shopify Customer List Database

- Get OpenX user’s DB Worldwide

- Get PubMatic user’s DB Worldwide

- E-commerce websites using Magento

Install Base Data

- Companies that Use Slack

- Deltek Users Email List

- Crestron Users Email List

- Yardi Users List

- IBM DBMS Users Email List

- Lawson Software Users List

- Eloqua Users Email List

- Bond Adapt Users Email List

- Rackspace Users Email List

- Sybase DBMS Users Email List

- Comcast Users Email List

- Nortel Users Email List

- Symantec Users Email List

- OpenText Users Email List

- Websense Users Email List

- Citrix Users Email List

- Kronos Users Email List

- MS Dynamics NAV Users Email List

- Sage ACT CRM Users List

- MuleSoft Customers List

- Java Users Email List

- Pivotal CRM Users List

- Onyx CRM Users List

- Aruba Networks Users List

- Accellion Users Email List

- Xero Users Email List

- Sage 50 Users Email List

- Accounting Software Users Email List

- APM Software Users Email List

- Amazon RDS Users Email List

- AirWatch Users Email List

- Axway Users Email List

- Workbooks CRM Users Email List

- Altair Users Email List

- Velti Users Email List

- Apache Spark Users Email List

- Altium Users Email List

- Apple Users Email List

- GoldMine CRM Users Email List

- Epicor ERP Users Email List

- Unit4 Users Email List

- Microsoft Dynamics CRM Users List

- Microsoft Azure Users Email List

- Oracle Database Users List

- Marketo Users List

- Amdocs CRM Users Email List

- Amazon Web Services Users Email List

- Maximizer CRM Users List

- Atlassian Users Email List

- Twilio Customers List

- ESRI Users Email List

- Infor Users Email List

- Apache Mailing List

- VMware Users Email List

- Microsoft Dynamic GP Users Email List

- IBM Mainframe Users Email List

- Siebel CRM Users List

- Avaya Users Email List

- ERP Users Email List

- ADP Client List

- QuickBooks Customers List

- NetSuite CRM Users Email List

- Hadoop Users Email List

- Big Data Companies List

- Cisco Customer List

- Cloudflare Website List

- Workday Customer List

- SharePoint User List

- Companies Using Snapchat

- List Of Skype Contacts

- Debian Users List

- CentOS User List

- SugarCRM Users Email List

- Ubuntu Users List

- Stripe Customers List

- MySQL Users List

- PeopleSoft Users Email List

- SAP Users Email List

- ServiceNow Users Email List

- IBM Users Email List

- MongoDB Users List

- Linux Users List

- Cloud Computing Industry Email List

- Politically Exposed Person List

- Email Hosting Providers Data

- Taboola Customers Email List

- PHP Users Email List

- Drupal Users Email Lists

- Website Data of Payment Technology

- Websites Data using Framework Technologies

- BigCommerce Customers Email List

- Adobe CQ Customers Email Lists

- E-commerce Website Customer Using Blogger, Joomla, Wix

- Amazon AWS Data Partner

- Laravel Customer Email List

- Websites Using Smart Ad Server Reseller

- Database of Rubicon Project Consumers

- Rocket Fuel Consumers Worldwide

- OpenX Customer list

- Pubmatic Customer List

- IponWeb BidSwitch Customer List

- Live Integral Ad Science Website Database

- IndexExchange Reseller Users Database

- Google Reseller Website Consumer List

- Google Direct Website Consumer List

- Website Data DoubleVerify Users

- AppNexus US Customers Database

- Amazon Ad System Customer List

- Live Advertising Sites Users List

- Ads.txt Customers List

- Adobe Audience Manager Users List

- Get vCita Users Database Worldwide

- Live Reevoo Websites Database

- Live Customer Websites Using SAP Hybris

- Netsuite Customers Data

- Database of Websites Using Manychat

- Insightly Website Global Consumer Database

- Infusionsoft Website Users List

- Live Customer Websites Using Drift

- Capterra Website Users Database

- BPM Online Website Users Database

- Get Alexa Top 100 Website Database

- Amazon Website Customers in US

- Zendesk Customers List Database Worldwide

- WP-Members Plugin Users Database

- Get WordPress Website Consumers List

- WooCommerce Plugin Users Database

- Get S2Member Website Database

- Database of ReCharge Payment Website Users

- Red Hat Enterprise Linux Users Data

- Ruby on Rails Consumer Database

- Paid Memberships Pro Website Users Data

- PrestaShop Website Users Data

- Websites using PayPal Subscribe Button

- Volusion Ecommerce Website Consumer List

- Database of MemberMouse Users Worldwide

- Database of Memberleap Users Worldwide

- Get Memberium Users Database

- Get MailChimp Users List

- Live Google Adwords Conversion Websites

- Google AdSense Website Consumer Data

- Get Cratejoy Users Data Worldwide

- Live Chargebee Users Database

- Websites Using Cart Functionality Option

- Shopify Customer List Database

- Gentoo Linux Website Users Data

- Get OpenX user’s DB Worldwide

- Get PubMatic user’s DB Worldwide

- Get Criteo User’s DB Worldwide

- Get ContextWeb User’s DB Worldwide (100 leads)

- E-commerce websites using Magento

- Get Exclusive Infusionsoft users data Globally (200 leads)

- Get Genuine Memberium Users Database Worldwide (100 leads)

- SaaS companies Email List- List of SaaS companies

- Infusionsoft Users Worldwide

- Websites using MailChimp

- Live Customer Websites using WordPress

- Hubspot Customer List Worldwide

Healthcare

- Healthcare Email Lists

- Transplants Nurses Email List

- Transplant Surgeons Email List

- Thoracic Surgeons Mailing List

- Surgical Specialists Mailing List

- Sports Medicine Specialist Email List

- Social Service Director Email List

- Surgery Services Director Mailing List

- Healthcare Professionals Email List

- Chief of Neurosurgery Email List

- Chief of Anesthesiology Email List

- Director Of Nursing Email List

- Hospital Executives Email List

- Physician Recruiters Email List

- Healthcare Executives Email List

- Alternate Care Specialists Mailing Database

- Neonatal Care Director Email List

- Surgical Appliances Manufacturers Email List

- Emergency Medical Dispatcher Email List

- Preventive Medicine Email List

- PACS Administrators Email List

- Endodontics Specialist Email List

- Infectious Disease Specialist Email List

- Family Practitioners Email List

- Family Planning Nurses Email List

- Acute Care Nurse Practitioners Email List

- Medical Laboratories Mailing List

- Addiction Counselors Email List

- Chemical Pathologist Email List

- Lab Director Email List

- Clinical Lab Scientist Email List

- Recreational Therapist Email List

- Diagnostic Radiologist Email List

- Medical Office Manager Email List

- Hospital IT Directors Email List

- Dental Surgeons Email List

- Interventional Cardiologist Email List

- Addiction Medicine Specialist Email List

- Chiropodist Email List

- Colorectal Surgeons Email List

- Dialysis Nurses Email List

- Obstetricians Email List

- Sonographer Email List

- Reflexologists Email List

- Perinatologist Email List

- Denturists Email List

- Otolaryngologist Email List

- Endocrinology Nurses Email List

- Dental Clinics Email List

- Urgent Care Centers Email List

- Perioperative Nurses Email List

- ADA Dentists Email List

- Hygienists Email List

- Emergency Medicine Specialist Email List

- ENT Nurse Practitioners Email List

- Military Nurses Email List

- Certified Nursing Assistants Email List

- Ambulatory Care Nurses Email List

- Critical Care Nurses Email List

- Neurology Nurses Email List

- Geriatric Nurses Email List

- Cardiac Care Nurses Email List

- Hospital Procurement Email List

- ENT Specialists Email List

- Nuclear Medicine Specialist Email List

- Hospital CFO Email List

- Emergency Medicine Email List

- Certified Registered Nurse Anesthetist Email List

- Hospital CIO Email List

- Family Medicine Specialist Email List

- Medical Equipment Manufacturers List

- Periodontist Email List

- Chiropractor Mailing List

- Hospital CEO Email List

- Registered Nurses Mailing List

- Accountable Care Organizations List

- List of Allied Health Professionals

- Federally Qualified Health Center List

- Ambulatory Surgery Centers Email List

- Diagnostic Imaging Centers Email List

- Nursing Homes Email List

- Clinics Email List

- Medical Director Email List

- Diabetes Specialist Email List

- Hand Surgeon Email List

- Mental Health Specialist Email List

- Dental Laboratories Email List

- Physician Assistants Email List

- Primary Care Physicians Email List

- Nurse Practitioners Email List

- General Practitioner Email List

- Orthodontist Email List

- Social Worker Email Addresses

- Occupational Therapist Email List

- Geriatrician Email List

- Hepatologist Email List

- Internal Medicine Email List

- Surgeons Email List

- Dietitian Email List

- Pharmacists Email List

- Massage Therapist Email List

- Physical Therapist Email List

- Osteopathic Physicians Email List

- Allergist/Immunologist Email List

- Prosthodontist Email List

- Internist Email List

- Cosmetologists Email List

- Oral Surgeons Email List

- Neurosurgeon Email List

- Medical Geneticist Email List

- ENT Doctor Email List

- Hypnotists Email List

- Epidemiologist Email List

- Neuropathologist Email List

- Naturopathic Doctors Email List

- Psychiatrists Email List

- Optician Email List

- Phlebotomist Email List

- Gastroenterologist Specialist Email List

- Neonatologist Email List

- Clinical Lipidologist Email List

- Nephrologist Email List

- Dental Hygienists Email List

- Audiologist Email List

- Hematologist Email List

- Nutritionists Email List

- Sleep Medicine Specialists Email List

- Plastic Surgeons Email List

- Traumatologist Email List

- Pulmonologists Email List

- Pathologists Email List

- Vascular Surgeons Email List

- Urologists Email List

- Rheumatologist Email List

- Endocrinologist Email List

- Anesthesiologist Email List

- General Surgeon Email List

- Physician Email Lists

- Neurologists Email List

- Gynecologist Email List

- Cardiologist Email List

- Dental Email List

- Veterinarian Email List

- Podiatrists Email List

- Dermatologist Email List

- Pediatrician Email List

- Optometrist Email List

- Chief Medical Officer Email List

- Pharmaceutical Email Lists

- Oncologist Email List

- Acupuncturist Email List

- Chiropractors Email List

- Ophthalmologist Email List

- Nurses Email List

- Radiologist Email List

- Orthopedic Surgeons Email Lists

- Hospital Email List

- Psychologist Email List

- Get Database of Health Stores Worldwide

Anti-Money Laundering Sanction List

Products

Datarade

Jobs Feed Data

Pre Scrapped Data

Amazon AWS Data partner

Worldwide Funding Data Feed

Zoho Address appending solution

Pre Scraped Data

B2B Data

B2C Data

Install Base Data

Partner Base Data

CRM / ERP Users Data

Industry Title Wise Data

WORKING HOURS:

Monday – Friday: 8am – 8:30pm est

Weekends: 8am – 2pm Holidays: Closed