In any business, you could be dealing with a variety of people but what if one of these people who you are associating with turns out to be a PEP? PEP or Politically Exposed Persons are individuals who hold prominent positions in government, politics, or public administration. What must you do if you discover that the client representative you are dealing with is a PEP?

Perhaps you would be a bit careful in your dealings because you could be at risk of facing corruption or money laundering. However, this might not suffice. If they have been marked as PEPs, your government would need you to follow a due diligence procedure to keep them under scrutiny. For due diligence, you need to check their activities and assess the risks involved. If the risk is high, you might want to reconsider the offer, but due diligence might suffice if it is not.

But how do you recognize if your client is a PEP? What kind of people make it to this sanction list? Do we have any activities identified that raise red flags? Let us explore.

Financial Action Task Force (FATF), an intergovernmental organization that was established by the G7 group to combat money laundering and terrorist financing, has identified certain red flags that can help detect PEPs. These flags could be attached to identity shielding, suspicious behavior, position in an organization, industry, transactions, products, and services based on the level of risk involved.

| Risk Category | Red Flags |

| Identity Shielding | PEP hides identity by assigning legal ownership to others, interacts through intermediaries, and uses corporate vehicles without business context. |

| Suspicious behaviour | Some behaviour that is flagged as suspicious includes being secretive about funds, providing inaccurate information, denial of visa, cross-border movement of funds, and high flow of wire transfers. |

| Position in an organization | Influence or control over organization funds, government accounts, or financial institutions. |

| Industries | High-risk industries include banking & finance, construction, mining & extraction, military & defines, public goods supervision, and association with government agencies. |

| Transactions |

These included accounts showing short activities after long gaps, private banking demands, massive global wire transfers, anonymous payments, use of multiple accounts, and transfers missing beneficiaries. |

| Products & Services | Organizations in the scrutiny are businesses dealing with foreign clientele, concentration accounts, trust providers, invaluable goods dealers, high-value transport vehicle providers, and real estate businesses. |

| Local indicators |

Countries with a high risk of corruption, mono-economies, and no registration with anti-corruption conventions like UNCAC are flagged. |

(Source: FATF)

A list of politically exposed persons is maintained by regulatory bodies and can be obtained through the PEP list provider. The lists contain names of individuals and red flags that you must watch for. But how can we use these lists to identify if people in our databases match the PEPs? And what if we discover a new profile, not already listed, does it have to be reported?

How can we identify PEPs?

A PEP can be a government official, a member of parliament, a member of a court, an army officer, a member of supervisory bodies, or a property owner. Data on these individuals can be gathered from public domains, public registers, and commercial databases by organizations. The information collected is then reviewed to identify red flags as identified earlier. For instance, if an individual is found to have wealth created outside of the regular source of income, this could be a red flag.

However, a simpler approach could be to obtain a PEP list from government or media sources. These sources maintain PEP lists with details of individuals marked as high-risk. Certain PEP databases have names while others have details like functions, roles, and positions associated with PEP individuals.

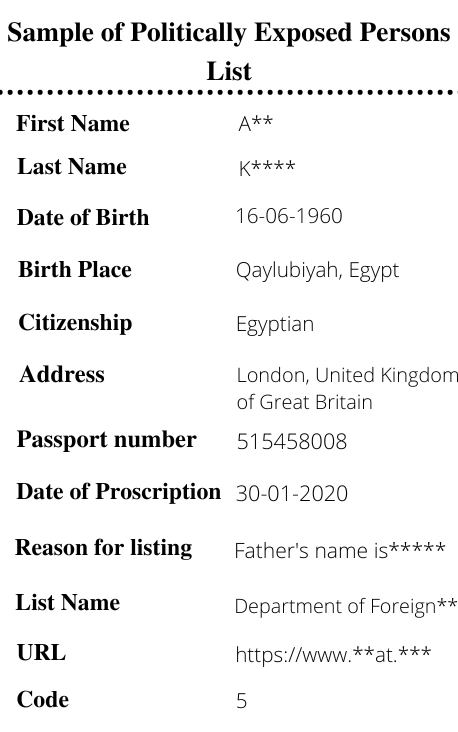

A name-wise PEP list would typically contain personal details, demographic information, passport number, and the reason for listing. The lists can be domestic containing details of people holding public positions, foreign officials holding positions outside their dominion, or individuals holding public positions in international organizations like the UN, WTO, or NATO. BizProspex maintains a demographic database of PEPs and thus, can help you with screening.

These lists can protect organizations from criminal activities. It is considered a duty of organizations to keep scrutiny on individuals and comply with AML regulations. Failing this would attract penalties from regulators.

What can be done if a person is identified in the PEP list?

As per Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (MLR 2017), in the event of identification of a PEP, approval is required from senior management. Close monitoring of business associations is needed and adequate measures must be taken to establish sources of income and wealth (Source: UK Law Society).

If the individual is in the low-risk PEP category and there is no unusual funding identified, basic questioning can help mitigate threats. However, for high-risk flags like an unusual source of income and high-risk transactions, documentary evidence is required to be collected, and enhanced due diligence is needed.

If a money laundering activity is observed, the organization’s Money Laundering Reporting Officer (MLRO) has to be informed and a Suspicious Activity Report (SAR) needs to be filed by National Crime Agency.

Whether it is the compliance need posed by the government or your own interest, keeping a tab on high-risk PEP individuals through due diligence is required. Otherwise, your organization can fall victim to corruption or a dent in reputation because of the involvement of your associations in illegal activities. However, without access to an updated and accurate PEPs list, you would not have an idea of what trouble a relationship can get you into.

BizProspex, as a leading provider of PEP databases, aml data, and global sanctions lists maintains a detailed dataset of PEPs including individuals and companies that you can use to screen individuals and stay safe.